state taxes|state tax usa : Bacolod State income tax isn't always straightforward and easy to understand, particularly for parties earning income in different jurisdictions. Tingnan ang higit pa OK, I don't have a 4K monitor, but if I understand correctly I should still be able to see them, the image should simply be seen in full HD and not in 4K. I tried following all the instructions I found on the web (increase the file and disk cache duration to 12,000 ms, use DirectX/DirectDraw as video output, disable hardware accelerated .

PH0 · wisconsin state taxes

PH1 · taxation and finance

PH2 · state tax usa

PH3 · state income tax per month

PH4 · state income tax

PH5 · pay state taxes online

PH6 · georgia state taxes

PH7 · dept of taxation and finance

PH8 · Iba pa

Drive test lang mga KatroopapsComment down ok na rin takbo nya#LIKE#SHARE#SUBSCRIBE

state taxes*******State income tax is a direct tax levied by a state on income earned in or from the state. In your state of residence, it may mean all your income . Tingnan ang higit paTax laws, rates, procedures, and forms vary widely from state to state. Filing deadlines also vary, but for individuals, state tax day usually falls on the . Tingnan ang higit pa

State income tax isn't always straightforward and easy to understand, particularly for parties earning income in different jurisdictions. Tingnan ang higit paIn addition to federal tax, taxpayers can owe taxes to the state(s) where they live or do business. You are no longer permitted to be taxed by more . Tingnan ang higit pa Find out how much you'll pay in California state income taxes given your annual income. Customize using your filing status, deductions, exemptions and more. State income tax rates can raise your tax bill. Find your state's income tax rate, see how it compares to others and see a list of .Welcome to the California Tax Service Center, sponsored by the California Fed State Partnership. Our partnership of tax agencies includes Board of Equalization, California .Calculate. After-Tax Income. $59,552. After-Tax Income Total Income Tax. Federal taxes. Marginal tax rate 22% Effective tax rate 10.94% Federal income tax $7,660. State taxes..

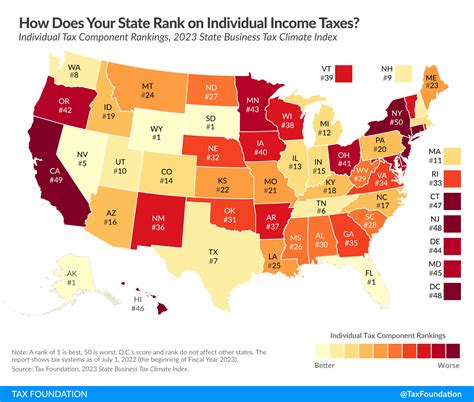

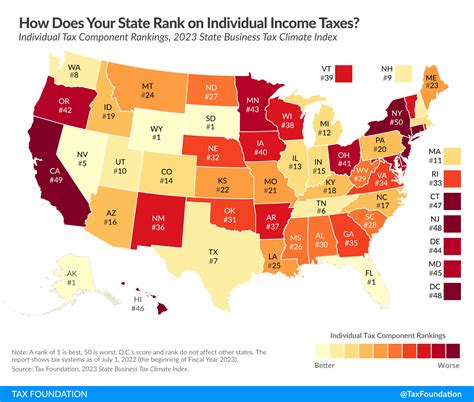

How much of your income goes to state and local taxes? Find out the rankings, trends, and factors that affect tax burdens across the US in this study. Learn .state taxesCalifornia income tax rate: 1.00% - 13.30% Median household income in California: $91,905 (U.S. Census Bureau) Number of cities that have local income taxes: 0. How .California Franchise Tax Board. File a return, make a payment, or check your refund. Log in to your MyFTB account. Follow the links to popular topics, online services . 5 days ago

How do taxes in your state compare regionally and nationally? Facts and Figures, a resource we’ve provided to U.S. taxpayers and legislators since 1941, serves .Department of Taxation | Ohio.gov. As the April 15 personal income tax deadline approaches, the Ohio Department of Taxation is expanding their customer service phone line and Welcome Center hours for taxpayers. Saturday, April 13th from 9 a.m. to noon the Welcome Center will be open for service. Phone lines on April 10th, 11th, 12th, and 15th .

Online Services. Online Services is the fastest, most convenient way to do business with the Tax Department. With an Online Services account, you can make a payment, respond to a letter from the department, and more—anytime, anywhere. If you don’t already have an account, it’s easy to create one! Log in. Create Account.state taxes state tax usa Online Services. Online Services is the fastest, most convenient way to do business with the Tax Department. With an Online Services account, you can make a payment, respond to a letter from the department, and more—anytime, anywhere. If you don’t already have an account, it’s easy to create one! Log in. Create Account.myPATH is the department's easy-to-use online system available for taxpayers who file and pay certain tax types, including individual and business taxes, as well as Property Tax/Rent Rebate . Keystone .Litter tax due May 1 If your business is registered for litter tax, you'll need to file and pay the tax by May 1. Read More. . Credit for Taxes Paid to Another State. Credit for Taxes Paid to Another State - Supporting Forms; Low Income Individuals Credit; Farming & Agriculture Credits; Environmental Credits. Pay personal income tax owed with your return. Pay income tax through Online Services, regardless of how you file your return. You can pay, or schedule a payment for, any day up to and including the due date. If you apply for an extension of time to file and owe tax, you need to make your extension payment by the due date. Pay personal .state tax usa Register to use the e-Business Center to file and pay certain tax types. The e-Business Center allows you to view your filing and paying history and grant a representative access to your account. To use the e-Business Center you must register your business with NCDOR and create an NCID user ID and password. Note: The e .Income Tax Filing Requirements. For tax years ending on or before December 31, 2019, Individuals with an adjusted gross income of at least $5,500 must file taxes, and an Arizona resident is subject to tax on all income, including from other states.For individuals with questions regarding income tax return filings and payments, they can email [email protected]. NEW* iFile Registration Tutorial for first time users. iFile has enhanced security protocols in place for users new to online filing. Watch the video tutorial today and find out just how easy it is to use iFile.State tax levels indicate both the tax burden and the services a state can afford to provide residents. States use a different combination of sales, income, excise taxes, and user fees. Some are levied directly from residents and others are levied indirectly. This table includes the per capita tax collected at the state level.Texas Comptroller of Public Accounts The Texas Comptroller’s office is the state’s chief tax collector, accountant, revenue estimator and treasurer. This office strives to provide you the best possible services and resources to do business in Texas. This website provides you with easy access to tax forms, lookup tools and the ability to file and pay taxes.Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in FY 06/07; (3) Oversee property .Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings . The sales tax is 6.25% at the state level, and local taxes can be added on. Texas also imposes a cigarette tax, a gas tax, and a hotel tax. There's no personal property tax except on property used for business purposes. Real estate taxes are set, and appraisals are performed by county districts. Numerous property tax exemptions are .

Important note: Some of the forms and instructions on this site do not reflect recent changes in Tax Department services and contact information. Please see Form TP-64, Notice to Taxpayers Requesting Information or Assistance from the Tax Department, for updated information if you are using any documents not revised since .

This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Consult with a translator for official business. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide.Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually; (2) Enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in FY 06/07; (3) Oversee property .Check your federal tax refund status. Before checking on your refund, have the following ready: Social Security number or Individual Taxpayer Identification Number (ITIN) Filing status. The exact whole dollar amount of your refund. Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online.We are currently issuing Income Tax refunds for the 2023 tax season. Paper checks are issued from the "Property Tax Relief Fund" and direct deposits are made as " State of N.J. NJSTTAXRFD." Check Refund Status. 2023 Senior Freeze Applications. We mailed Senior Freeze applications on February 12, 2024. We will begin issuing 2023 payments to .

8590 videos found with lyninii+alua+leaks. Watch lyninii+alua+leaks viral videos, nude photos, sex scandals, and other leaked sexy content. If you have any requests, concerns, or suggestions related to lyninii+alua+leaks, you can leave your message in the comment section found at the bottom part of every post. We love to show you the best .

state taxes|state tax usa